價格:免費

更新日期:2019-04-30

檔案大小:4.3 MB

目前版本:1.14

版本需求:需要 iOS 10.0 或以上版本。與 iPad 相容。

支援語言:德語, 英語

The world of financial markets has become more uncertain in recent years. One way to create a more crisis protected portfolio, is the systematic diversification (strategic asset allocation). Diversification is in the long term responsible for approximately 90 % of the yield changes. Only 2-5% of the yield changes are linked to the choice of the right investment moment (timing). This makes the choice of asset classes so important. Another benefit of diversification is that you do not swim with or against the flow of the markets, but ignore it.

Diversification has always been suggested, but is usually limited mostly only on the asset classes of money market, bonds and equities.

The added value of other asset classes remains closed to most investors. The purpose of the app Asset Allocation Analyzer (AAAnalyzer) is to present the user with the idea of a broad diversification.

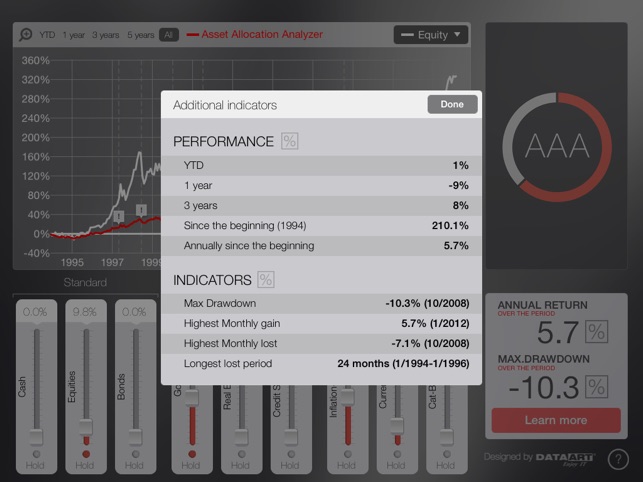

The user selects out of the up to nine asset classes a desired combination and distributes his money with a chosen percentage to each. Three of them are free, others can be purchased through in-app buys. The weighting is performed by the operation of sliders. The chart shows him immediately how his investment would have behaved while using the sliders. In the calculation, at year end, distribution of assets are restored to their selected values and funds are reallocated proportionally over all asset classes. The risk-return profile of the selected combination is carried out by the figures “Year Performance” (Yield p.a.) and “Maximum Drawdown” (Worst Timing: Buy at the highest and then selling at the lowest price). For the slider fixed percentages can be specified: for example, 10 % money market and 10% gold.

The AAAnalyzer shows the interested investor on the basis of real fund products, each representing an asset class how such a portfolio would have developed within the last 20 years. During this period are Asian crisis of 1997, Russian Default in 1998, bursting of the Internet bubble in 2000, the 9/11 in 2001 and Lehman Default in 2008. Through this long time series investors can develop an individual risk-return feeling more realistic than in dry figures.

The first three asset classes are money market, stocks and bonds. Through an in-app buy gold, real estate, credit risk premiums can be purchased. With another purchase one acquires inflations linked products, foreign currencies and catastrophe bonds.

The majority of the asset class are represented by ETFs (Exchange Traded Funds / Products), otherwise classic investment funds. For the periods in which the fund did not exist, recalculations (back tests) or replacement indices (total return) were taken.

The time axes are adjustable and the risk - return profile can be illustrated in more detail by additional indicators.

Sliders can be hidden to allow unrestricted control over the desired percentages.

The AAAnalyzer is linked with a website via "Learn more". There the user finds further information about the asset classes and their importance for the diversification. It includes blogs and links where additional information is conveyed.

支援平台:iPad